In News

- According to the IMF’s World Economic Output 2020 released recently, China has now overtaken the US to become the world’s largest economy.

How IMF Calculates

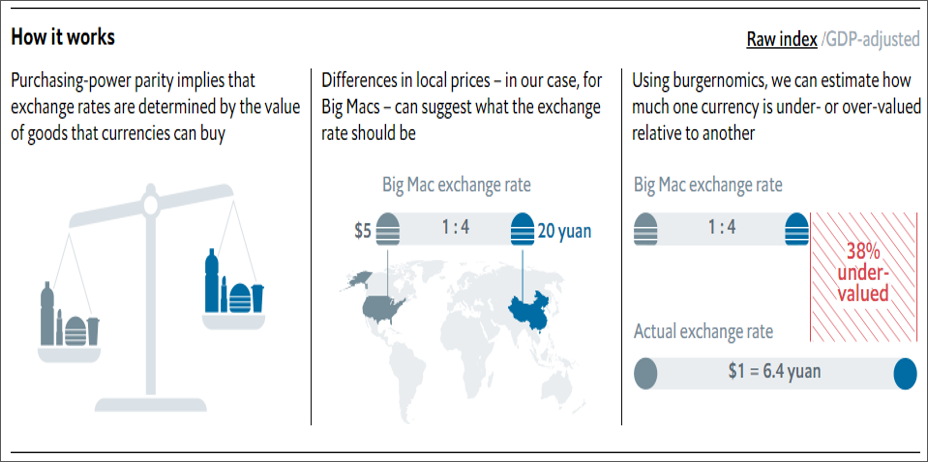

- International Monetary Fund (IMF), using the more reliable and now widely accepted yardstick, called the Purchasing Power Parity (PPP), has determined China’s economy at $24.2 trillion compared to America’s $20.8 trillion.

- The PPP calculation method used by the IMF enables to compare how much you can buy for your money in different countries.

Problem with Traditional Method

- The economists have traditionally been using MER (market exchange rates) to calculate GDP, which doesn’t reflect the real figures.

- The MER method is being viewed with extreme suspicion because it underestimates the buying power of the currencies of many countries.

- As a result, the currencies of many nations are undervalued against the dollar.

- With PPP adjustment, IMF estimates China’s economic output outmanoeuvring the US’s by a huge margin.

- IMF is clear in its report, it says the PPP “eliminates differences in price levels between economies” and thus compares national economies in terms of how much each nation can buy with its own currency at the prices items sell for there.

- After the IMF, the CIA also decided to switch from MER to PPP in its annual assessment of national economies.

- The CIA Factbook notes that

- “The official exchange rate measure of GDP is not an accurate measure of China’s output;

- GDP at the official exchange rate (MER GDP) substantially understates the actual level of China’s output vis-a-vis the rest of the world;

- in China’s situation, GDP at purchasing power parity provides the best measure for comparing output across countries.”

- To tide over the inconsistencies with traditional methods, The Economist invented a new method called the The Big Mac Index to determine whether the currencies were at a correct level.

- The fact is one US dollar can buy nearly twice as much in China than in America itself, and the current market exchange rates hardly acknowledge that.

- In 2019 China’s workers produced over 99 trillion yuan worth of goods and services.

- America’s produced $21.4 trillion-worth. Since 6.9 yuan bought a dollar last year, on average, China’s GDP was worth only $14trn when converted into dollars at market rates.

- That was still well short of America’

- But 6.9 yuan stretches further in China than a dollar goes in America.

- One example is McDonald’s Big Mac.

- It costs about 21.70 yuan in China and $5.71 in America.

- By that measure, 3.8 yuan buys as much as a dollar.

- But if that is the case, then 99trn yuan can buy as much as $26trn, and China’s economy is already considerably bigger than America’

- China’s economic growth rate has been growing at a mind-boggling rate of around 10% for almost the last 30 years.

- The country has witnessed startling growth in every sector, with the manufacturing sector being the engine of overall resurgence.

- It has made unstoppable advances in its military power, building and accumulating world-class defence equipment.

- According to the IMF estimates, China will grow by 8.2% next year, down a full percentage point from the IMF’s April estimate but strong enough to account for more than one-quarter of global growth.

The Big Mac Index

- The big mac index was invented by The Economist in 1986 as a lighthearted guide to whether currencies are at their “correct”

- It is based on the theory of purchasing-power parity (PPP), the notion that in the long run exchange rates should move towards the rate that would equalise the prices of an identical basket of goods and services (in this case, a burger) in any two countries.

- Burgernomics was never intended as a precise gauge of currency misalignment, merely a tool to make exchange-rate theory more digestible.

- The GDP-adjusted index addresses the criticism that you would expect average burger prices to be cheaper in poor countries than in rich ones because labour costs are lower.

- PPP signals where exchange rates should be heading in the long run, as a country like China gets richer, but it says little about today’s equilibrium rate.

- The relationship between prices and GDP per person may be a better guide to the current fair value of a currency.

EURASIANTIMES, THE ECONOMIST